Coronavirus Relief Bill Temporarily Revives NOL Carrybacks and Delays 80% Limitation

BOSTON — The Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), signed into law on March 27, 2020, temporarily suspends certain business loss limitations that were added to the code in the 2017 “Tax Cuts and Jobs Act” (“TCJA”). Under TCJA, companies were limited from using net operating losses (“NOLs”) to offset more than 80% of their taxable income, and NOLs were no longer allowed to be carried back to offset taxable income earned in previous years.

The CARES act (1) extends the ability to use NOLs to offset 100% of income, and (2) allows losses earned in 2018, 2019, and 2020 to be carried back five years. Most corporations will not have yet filed their 2019 returns, but if they did and were impacted by the 80% of income limitation, but had enough losses to offset the additional 20%, they should consider filing amended returns to take advantage of this temporary provision.

If a company had significant losses, as yet unused on their tax returns in 2018 or 2019, the five year carryback should likewise be evaluated to see if any amended returns are desirable. This provision does have limitations disallowing real estate investment trusts “REITs” from using the carryback, and disallowing losses to offset any income included under the Code Section 965 “transition tax” added by TCJA. However, companies can elect to skip prior years in which foreign earnings were included in gross income, allowing them to extend the losses farther back.

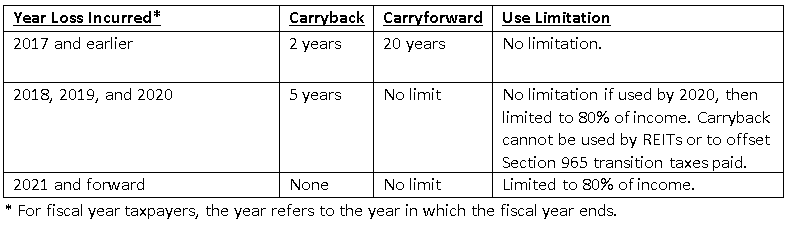

Given the multiple changes to NOLs, it will be important for companies to keep track of tax losses earned to determine how far back they can be carried and how much of those losses may be used to offset income. See table below.

In a similar vein, the CARES act also delays the application of TCJA’s new Code Section 461(l), which limits the use of business losses to offset investment gains and other non-business income. The limitation will not apply until 2021.

As always, this summary is for informational purposes only and is not tax or legal advice. Always consult a professional tax advisor for advice in light of a taxpayer’s particular circumstances.

For more information on net operating losses, please contact:

Michael Lieberman

(617) 918-7083

MLieberman@BlaisTaxLaw.com

Benjamin Damsky

(617) 918-7084

BDamsky@BlaisTaxLaw.com

Travis Blais

(617) 918-7081

TBlais@BlaisTaxLaw.com